Effective Communication with Investors and Stakeholders Training

Effective Communication with Investors and Stakeholders Training is designed to equip corporate leaders, finance professionals, entrepreneurs, and communication teams with the essential skills to articulate company value, manage expectations, and foster long-term relationships with stakeholders and investors.

Course Overview

Effective Communication with Investors and Stakeholders Training

Introduction

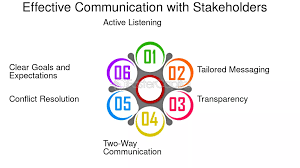

Clear, strategic, and transparent communication with investors and stakeholders is the cornerstone of sustainable business growth and market trust. Effective Communication with Investors and Stakeholders Training is designed to equip corporate leaders, finance professionals, entrepreneurs, and communication teams with the essential skills to articulate company value, manage expectations, and foster long-term relationships with stakeholders and investors. Whether you're preparing for investor meetings, annual reports, funding rounds, or public disclosures, this training sharpens your ability to deliver accurate, compelling, and credible information that inspires confidence and strengthens partnerships.

This comprehensive course integrates real-world investor relations case studies, stakeholder engagement strategies, and professional communication techniques to ensure that participants can navigate both growth conversations and challenging disclosures with poise. Effective communication builds trust — and this training empowers participants to master the language of leadership, manage financial narratives, respond to investor queries with confidence, and maintain transparent dialogue with stakeholders through all stages of the business lifecycle.

Course duration

10 Days

Course Objectives

1. Understand the principles of investor and stakeholder communication.

2. Develop clear and credible financial communication strategies.

3. Craft persuasive narratives for investment proposals and reports.

4. Master techniques for delivering investor presentations and pitches.

5. Strengthen stakeholder trust through consistent engagement.

6. Manage difficult conversations with transparency and diplomacy.

7. Align messaging with corporate goals and shareholder expectations.

8. Use data storytelling to support business growth narratives.

9. Prepare for investor Q&A sessions with confidence.

10. Leverage digital channels for stakeholder communication.

11. Handle communication during mergers, acquisitions, and funding rounds.

12. Create ethical and compliant investor communication frameworks.

13. Build long-term relationships with both internal and external stakeholders.

Organizational Benefits

1. Improve investor confidence and market credibility.

2. Strengthen stakeholder alignment and engagement.

3. Enhance transparency and corporate governance practices.

4. Increase the success rate of investment pitches and funding rounds.

5. Reduce miscommunication risks in financial disclosures.

6. Equip leadership teams with strategic communication tools.

7. Boost company reputation in financial and public markets.

8. Foster sustainable relationships with shareholders and partners.

9. Support business continuity through clear stakeholder messaging.

10. Build a resilient communication strategy for organizational growth.

Target Participants

- CEOs and Founders.

- CFOs and Finance Managers.

- Investor Relations Professionals.

- Corporate Communications Managers.

- Public Relations and Media Specialists.

- Business Development Executives.

- Board Members and Company Directors.

- Entrepreneurs seeking funding or partnership growth.

Course Outline

Module 1: Foundations of Investor and Stakeholder Communication

- The role of communication in stakeholder and investor relations.

- Understanding stakeholder influence and expectations.

- Establishing communication protocols for different audiences.

- Strategic transparency: when, what, and how to communicate.

- Case Study: Warren Buffett’s annual shareholder letters.

Module 2: Investor Communication Strategy Development

- Identifying key investor segments and priorities.

- Crafting a compelling investor communication framework.

- Balancing financial detail with strategic vision.

- Storytelling techniques for investor buy-in.

- Case Study: Tesla’s investor communications evolution.

Module 3: Financial Narrative and Business Storytelling

- Translating financial data into actionable stories.

- Structuring investor presentations and reports.

- Clarifying metrics, forecasts, and KPIs.

- Using case studies and success stories to build trust.

- Case Study: Airbnb’s IPO investor pitch.

Module 4: Managing Investor Presentations and Pitches

- Preparing high-impact investor presentations.

- Delivering with confidence and clarity.

- Managing investor expectations in presentations.

- Handling objections and tough investor questions.

- Case Study: Netflix’s quarterly earnings calls.

Module 5: Stakeholder Engagement and Relationship Building

- Mapping stakeholder influence and interest.

- Creating stakeholder engagement plans.

- Building long-term trust and collaboration.

- Communicating during change and transformation.

- Case Study: Unilever’s sustainable stakeholder strategy.

Module 6: Crisis Communication for Investors and Stakeholders

- Communicating under financial or operational pressure.

- Managing investor sentiment during a downturn.

- Drafting crisis statements for transparency and control.

- Rebuilding trust after negative financial events.

- Case Study: Boeing’s communication post-737 Max crisis.

Module 7: Compliance and Ethics in Investor Communication

- Regulatory frameworks for investor communication.

- Ethical communication principles.

- Avoiding misleading financial disclosures.

- Aligning communications with corporate governance.

- Case Study: Enron’s communication failure and regulatory lessons.

Module 8: Digital and Social Media in Investor Communication

- Leveraging digital tools for real-time investor updates.

- Using LinkedIn, Twitter, and webinars for stakeholder reach.

- Managing investor relations websites effectively.

- Social media risk management during investor discussions.

- Case Study: Shopify’s digital-first investor communication strategy.

Module 9: Communicating Mergers, Acquisitions, and Fundraising

- Structuring M&A announcements.

- Communicating valuations and strategic intent.

- Managing stakeholder emotions during transitions.

- Delivering investor updates during fundraising rounds.

- Case Study: Disney’s acquisition of 21st Century Fox.

Module 10: Investor Q&A Preparation and Management

- Anticipating investor questions.

- Structuring clear and concise answers.

- Handling hostile or skeptical investor interactions.

- Using Q&A as a relationship-building opportunity.

- Case Study: Apple’s post-earnings Q&A sessions.

Module 11: Internal Communication Alignment

- Aligning investor messaging across departments.

- Training internal teams on investor-sensitive topics.

- Creating a unified narrative across the organization.

- Communicating non-public information internally.

- Case Study: Microsoft’s internal-external communication strategy.

Module 12: Visual Communication for Investors

- Designing compelling visual reports and investor decks.

- Using infographics to simplify financial data.

- Integrating visuals in investor presentations.

- Best practices for charting and graphical storytelling.

- Case Study: Slack’s visual storytelling during IPO.

Module 13: Annual Reports and Earnings Announcements

- Structuring effective annual reports.

- Best practices for quarterly earnings disclosures.

- Transparency in reporting financial setbacks.

- Delivering consistent annual messaging.

- Case Study: Coca-Cola’s investor reporting model.

Module 14: Relationship-Driven Investor Communication

- Building rapport beyond formal meetings.

- Investor events, roundtables, and networking best practices.

- Personalizing investor outreach.

- Communicating long-term vision, not just numbers.

- Case Study: Salesforce’s investor ecosystem model.

Module 15: Post-Investment Stakeholder Communication

- Maintaining engagement after funding rounds.

- Reporting milestones and setbacks to investors.

- Managing investor relations through growth phases.

- Preparing exit communication strategies.

- Case Study: Uber’s post-IPO investor communication approach.

Training Methodology

This course employs a participatory and hands-on approach to ensure practical learning, including:

- Interactive lectures and presentations.

- Group discussions and brainstorming sessions.

- Hands-on exercises using real-world datasets.