Training Course on Audit Committee Effectiveness and Financial Oversight

Training Course on Audit Committee Effectiveness and Financial Oversight is meticulously designed to equip members with the advanced knowledge and practical skills required to navigate complex financial reporting, internal controls, and governance challenges.

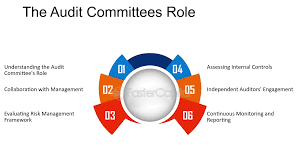

Skills Covered

Course Overview

Training Course on Audit Committee Effectiveness and Financial Oversight

Introduction

In today's dynamic corporate landscape, Audit Committees are increasingly pivotal to organizational integrity, risk management, and sustainable growth. Training Course on Audit Committee Effectiveness and Financial Oversight is meticulously designed to equip members with the advanced knowledge and practical skills required to navigate complex financial reporting, internal controls, and governance challenges. Participants will gain a comprehensive understanding of their fiduciary responsibilities, the evolving regulatory environment, and best practices in overseeing financial performance, external and internal audit functions, and enterprise-wide risks, ultimately fostering enhanced stakeholder confidence and corporate resilience.

This program delves into the critical intersection of corporate governance, financial transparency, and accountability. Through a blend of theoretical frameworks and real-world case studies, attendees will master the art of effective oversight, learning to identify emerging risks, challenge financial assertions, and champion a robust control environment. The course emphasizes the strategic role of the Audit Committee in driving organizational value, moving beyond mere compliance to become a proactive force for prudent financial stewardship and long-term strategic success.

Course Duration

10 days

Course Objectives

- Elevate understanding of the Audit Committee's integral role in modern corporate governance frameworks and board effectiveness.

- Develop advanced skills in scrutinizing complex financial statements, accounting policies, and disclosure requirements under evolving IFRS/GAAP standards.

- Implement robust internal control frameworks (e.g., COSO) to mitigate financial fraud risks and ensure operational efficiency.

- Foster productive engagement with external auditors, focusing on audit quality, auditor independence, and critical audit matters.

- Maximize the strategic value of the internal audit function in providing independent assurance and identifying operational improvements.

- Integrate the Audit Committee's oversight with the broader enterprise risk management (ERM) framework, including cybersecurity risk, ESG risks, and supply chain resilience.

- Stay abreast of the latest regulatory changes and their impact on Audit Committee responsibilities.

- Establish effective mechanisms for whistleblower protection and oversee internal investigations with integrity and discretion.

- Understand the Audit Committee's role in overseeing capital expenditure, mergers & acquisitions (M&A), and investment strategies.

- Address emerging risks related to digital transformation, AI in finance, data privacy, and cloud computing within financial oversight.

- Promote a strong ethical culture and tone at the top throughout the organization, preventing misconduct and fostering accountability.

- Enhance communication strategies with the Board, management, auditors, and external stakeholders for transparent reporting and investor relations.

- Implement metrics and conduct self-assessments to continuously evaluate and improve the Audit Committee's effectiveness and value creation.

Organizational Benefits

- Improved accuracy and reliability of financial reporting, fostering greater trust from investors and stakeholders.

- Proactive identification and mitigation of financial, operational, and strategic risks, reducing potential losses and reputational damage.

- Adherence to regulatory requirements, minimizing penalties and legal disputes.

- Robust internal control systems that safeguard assets, prevent fraud, and enhance operational efficiency.

- Demonstrates a commitment to good governance, attracting and retaining investors, and enhancing brand reputation.

- Provides the Board with reliable financial information and expert insights for informed strategic decisions.

- Promotes a culture of accountability throughout the organization, from the C-suite to operational levels.

- Transforms the Audit Committee from a compliance-focused body to a strategic asset that contributes to long-term organizational success.

Target Audience

- Current Audit Committee Members

- Aspiring Audit Committee Members.

- Board Members.

- Chief Financial Officers (CFOs) & Senior Finance Executives

- Chief Audit Executives (CAEs) & Internal Auditors

- External Auditors & Engagement Partners.

- Legal & Compliance Professionals.

- Company Secretaries & Governance Professionals

Course Outline

Module 1: The Evolving Landscape of Audit Committee Governance

- Defining the modern Audit Committee's mandate and responsibilities.

- Impact of recent corporate scandals and regulatory reforms

- The role of independence and financial literacy in committee composition.

- Understanding the Audit Committee charter and terms of reference.

- Case Study: Analyzing the collapse of Enron and the role of its Audit Committee in oversight failures.

Module 2: Core Financial Reporting Oversight

- Deep dive into IFRS/GAAP principles and their application.

- Scrutiny of complex accounting estimates, judgments, and significant transactions.

- Overview of consolidated financial statements and segment reporting.

- Understanding the Annual Report and financial narratives.

- Case Study: Reviewing a company's annual report to identify potential red flags in revenue recognition or off-balance sheet financing.

Module 3: Internal Controls Over Financial Reporting (ICFR)

- Implementing and monitoring the COSO Internal Control – Integrated Framework.

- Assessing the effectiveness of control design and operating effectiveness.

- Identifying and remediating internal control deficiencies.

- The role of the Audit Committee in overseeing management's ICFR assessment.

- Case Study: Analyzing a real-world scenario of a control breakdown leading to a material misstatement.

Module 4: Managing the External Audit Relationship

- Auditor independence, objectivity, and professional skepticism.

- Selecting, appointing, and overseeing the external auditor.

- Reviewing the audit plan, scope, and key audit matters (KAMs).

- Evaluating audit quality and challenging audit findings.

- Case Study: Discussing the challenges of auditor rotation and its impact on audit quality, drawing lessons from specific corporate examples.

Module 5: Elevating Internal Audit's Strategic Value

- The Institute of Internal Auditors (IIA) International Standards for the Professional Practice of Internal Auditing.

- Ensuring internal audit's independence, objectivity, and resource adequacy.

- Reviewing the internal audit plan, scope, and reporting.

- Leveraging internal audit for enterprise-wide risk assessments and process improvements.

- Case Study: Examining how a strong internal audit function helped a company uncover and rectify significant operational inefficiencies.

Module 6: Enterprise Risk Management (ERM) Integration

- Understanding the COSO Enterprise Risk Management – Integrating with Strategy and Performance framework.

- The Audit Committee's role in overseeing the organization's risk appetite and risk profile.

- Integrating financial risks with strategic, operational, and reputational risks.

- Reviewing risk assessment methodologies and mitigation strategies.

- Case Study: Analyzing a company's response to a major cybersecurity breach and the Audit Committee's oversight role.

Module 7: Cybersecurity and Data Privacy Oversight

- Understanding the landscape of cyber threats and data breaches.

- The Audit Committee's role in overseeing cybersecurity policies, controls, and incident response plans.

- Compliance with data privacy regulations (e.g., GDPR, CCPA).

- Assessing IT governance and digital transformation risks.

- Case Study: Debating the ethical and financial implications of a large-scale data breach on a global corporation.

Module 8: ESG (Environmental, Social, and Governance) Oversight

- The growing importance of ESG factors in financial reporting and investor decision-making.

- Understanding ESG reporting frameworks (e.g., SASB, TCFD, GRI).

- The Audit Committee's role in overseeing climate-related financial disclosures and social impact.

- Assessing the integrity of non-financial data and ESG assurance.

- Case Study: Analyzing how a company's poor ESG performance impacted its market valuation and reputation, and the Audit Committee's potential role in mitigation.

Module 9: Fraud Prevention, Detection, and Investigation

- Types of financial fraud and common fraud schemes.

- Establishing an anti-fraud program and fostering a culture of integrity.

- The Audit Committee's role in overseeing fraud investigations.

- Whistleblower policies and protection mechanisms.

- Case Study: Analyzing a significant accounting fraud case and identifying the red flags that an effective Audit Committee should have caught.

Module 10: Legal and Regulatory Compliance

- Staying current with national and international corporate governance codes and regulations.

- Understanding the implications of new legislation on financial reporting and audit.

- Oversight of compliance programs and ethical conduct policies.

- The Audit Committee's role in ensuring adherence to anti-money laundering (AML) and anti-bribery and corruption (ABC) laws.

- Case Study: Discussing the regulatory repercussions faced by a company due to non-compliance with industry-specific financial regulations.

Module 11: Capital Markets and M&A Oversight

- The Audit Committee's role in overseeing capital allocation decisions.

- Scrutinizing financial aspects of mergers, acquisitions, and divestitures.

- Understanding the accounting for complex financial instruments and derivatives.

- Oversight of debt and equity financing activities.

- Case Study: Analyzing the financial due diligence process for a major acquisition and the Audit Committee's role in reviewing the deal's financial implications.

Module 12: Communication, Reporting, and Stakeholder Engagement

- Effective communication with the Board of Directors and executive management.

- Drafting comprehensive and insightful Audit Committee reports.

- Engaging with shareholders and other key stakeholders on financial matters.

- Crisis communication strategies for financial incidents.

- Case Study: Reviewing examples of strong and weak Audit Committee reports and their impact on stakeholder perception.

Module 13: Audit Committee Effectiveness: Performance and Self-Assessment

- Key performance indicators (KPIs) for Audit Committee effectiveness.

- Conducting annual self-assessments and independent peer reviews.

- Identifying areas for improvement and continuous professional development.

- The role of the Audit Committee Chair in driving effectiveness.

- Case Study: Facilitated discussion on common challenges in Audit Committee effectiveness and strategies for overcoming them.

Module 14: Emerging Technologies and Their Impact on Oversight

- Understanding the implications of AI, blockchain, and automation on financial processes.

- Assessing the risks and opportunities of new technologies in financial reporting and audit.

- The Audit Committee's role in governing technology adoption and innovation.

- Data analytics for enhanced oversight and risk identification.

- Case Study: Exploring how a company leveraged AI in its financial close process and the Audit Committee's role in ensuring its integrity and control.

Module 15: Future Trends in Audit Committee Focus

- Anticipating future regulatory developments and their impact.

- The evolving role of the Audit Committee in sustainability and integrated reporting.

- Addressing the challenges of global operations and cross-border risks.

- Developing a forward-looking agenda for Audit Committee meetings.

- Case Study: Predicting potential future challenges for Audit Committees based on current global economic and technological trends.

Training Methodology

This course employs a highly interactive and practical training methodology, combining:

- Expert-Led Presentations: Engaging sessions delivered by seasoned professionals and industry leaders.

- Interactive Discussions: Facilitated group discussions to share insights, experiences, and best practices.

- Real-World Case Studies: In-depth analysis of actual corporate scenarios to apply theoretical concepts and develop critical thinking.

- Group Exercises & Workshops: Practical activities and problem-solving sessions to reinforce learning.

- Role-Playing Simulations: Simulating Audit Committee meetings and interactions with various stakeholders.

- Q&A Sessions: Opportunities for direct engagement with instructors and expert panels.

- Action Planning: Guided sessions to develop personalized action plans for implementing learned concepts.

Register as a group from 3 participants for a Discount

Send us an email: info@datastatresearch.org or call +254724527104

Certification

Upon successful completion of this training, participants will be issued with a globally- recognized certificate.

Tailor-Made Course

We also offer tailor-made courses based on your needs.

Key Notes

a. The participant must be conversant with English.

b. Upon completion of training the participant will be issued with an Authorized Training Certificate

c. Course duration is flexible and the contents can be modified to fit any number of days.

d. The course fee includes facilitation training materials, 2 coffee breaks, buffet lunch and A Certificate upon successful completio