Training Course on Behavioral Economics in Pension Design and Communication

Training Course on Behavioral Economics in Pension Design and Communication aims to equip pension professionals with insights into how behavioral economics can enhance the design of pension plans and improve communication strategies.

Skills Covered

Course Overview

Training Course on Behavioral Economics in Pension Design and Communication

Introduction

Training Course on Behavioral Economics in Pension Design and Communication aims to equip pension professionals with insights into how behavioral economics can enhance the design of pension plans and improve communication strategies. Understanding the psychological factors that influence decision-making is essential for creating effective retirement solutions that meet the needs of diverse member populations. Behavioral economics explores how cognitive biases, heuristics, and emotional factors impact individuals' financial choices. By applying these principles, pension designers can create more effective retirement plans that encourage saving, improve engagement, and enhance overall member satisfaction. Additionally, effective communication strategies can help overcome common misconceptions and motivate members to take proactive steps toward their retirement goals.

This course will delve into key concepts of behavioral economics and their applications in pension design, communication, and member engagement. Participants will explore strategies for framing information, utilizing nudges, and designing decision-making environments that promote positive financial behaviors. Through a combination of theoretical insights and practical applications, attendees will engage in case studies, interactive discussions, and hands-on exercises. By the end of this course, participants will have a comprehensive understanding of how to integrate behavioral economics into pension design and communication strategies. This training is essential for financial professionals looking to enhance their offerings and better serve their members.

Course Objectives

- Understand the principles of behavioral economics and their relevance to pension design.

- Analyze cognitive biases that affect retirement decision-making.

- Evaluate the role of nudges in encouraging positive financial behaviors.

- Explore effective communication strategies based on behavioral insights.

- Discuss the implications of behavioral economics for retirement plan design.

- Develop skills in applying behavioral strategies to enhance member engagement.

- Assess the effectiveness of behavioral interventions in pension communication.

- Identify best practices for designing decision-making environments.

- Create actionable strategies for applying behavioral economics in practice.

- Stay informed about emerging trends in behavioral finance.

- Measure the impact of behavioral approaches on retirement outcomes.

- Foster a culture of behavioral awareness within pension organizations.

- Enhance client relationships through informed behavioral strategies.

Target Audience

- Pension fund managers

- Financial advisors and planners

- Communications professionals in financial services

- HR representatives managing pension plans

- Compliance officers

- Data analysts in pension organizations

- Educators in finance and behavioral economics

- Policy makers in pension regulation

Course Duration: 5 Days

Course Modules

Module 1: Introduction to Behavioral Economics

- Define behavioral economics and its key concepts.

- Explore the historical development of behavioral finance.

- Discuss the relevance of behavioral economics to pension design.

- Identify common cognitive biases affecting financial decision-making.

- Review case studies demonstrating behavioral economics in action.

Module 2: Understanding Cognitive Biases

- Analyze biases that impact retirement savings and planning.

- Discuss the effects of loss aversion and present bias.

- Explore the role of overconfidence and framing in decision-making.

- Identify strategies to mitigate the impact of biases.

- Review examples of cognitive biases in real-world pension scenarios.

Module 3: The Role of Nudges in Pension Design

- Define nudges and their significance in behavioral economics.

- Discuss types of nudges applicable to retirement planning.

- Explore how to design nudges to encourage saving and participation.

- Identify successful nudge implementations in pension plans.

- Review case studies of organizations utilizing nudges effectively.

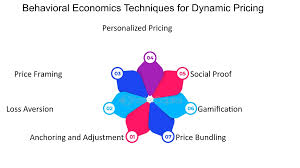

Module 4: Effective Communication Strategies

- Explore the importance of clear communication in pension management.

- Discuss techniques for framing information to enhance understanding.

- Identify best practices for communicating complex pension information.

- Explore the role of storytelling in engaging members.

- Review case studies of effective communication strategies.

Module 5: Designing Decision-Making Environments

- Discuss the principles of choice architecture in pension design.

- Identify how to structure choices to promote better decision-making.

- Explore the impact of default options on retirement savings.

- Analyze the significance of transparency and simplicity in design.

- Review examples of effective decision-making environments.

Module 6: Enhancing Member Engagement

- Discuss strategies for increasing member participation and engagement.

- Explore the role of behavioral insights in member communication.

- Identify techniques for personalizing communication to members.

- Review case studies of successful member engagement initiatives.

- Analyze the impact of engagement on retirement outcomes.

Module 7: Measuring the Effectiveness of Behavioral Interventions

- Explore metrics for evaluating the success of behavioral strategies.

- Discuss methods for gathering feedback on interventions.

- Identify key performance indicators (KPIs) for measuring impact.

- Review tools for monitoring and reporting on behavioral initiatives.

- Analyze case studies of organizations measuring effectiveness.

Module 8: Future Trends in Behavioral Economics and Pension Design

- Discuss emerging trends in behavioral economics and their implications.

- Explore the impact of technology on behavioral interventions.

- Identify potential disruptions in the pension landscape.

- Review the role of demographic changes on behavioral strategies.

- Analyze case studies of organizations adapting to future trends.

Training Methodology

- Interactive Workshops: Facilitated discussions, group exercises, and problem-solving activities.

- Case Studies: Real-world examples to illustrate successful community-based surveillance practices.

- Role-Playing and Simulations: Practice engaging communities in surveillance activities.

- Expert Presentations: Insights from experienced public health professionals and community leaders.

- Group Projects: Collaborative development of community surveillance plans.

- Action Planning: Development of personalized action plans for implementing community-based surveillance.

- Digital Tools and Resources: Utilization of online platforms for collaboration and learning.

- Peer-to-Peer Learning: Sharing experiences and insights on community engagement.

- Post-Training Support: Access to online forums, mentorship, and continued learning resources.

Register as a group from 3 participants for a Discount

Send us an email: info@datastatresearch.org or call +254724527104

Certification

Upon successful completion of this training, participants will be issued with a globally recognized certificate.

Tailor-Made Course

We also offer tailor-made courses based on your needs.

Key Notes

- Participants must be conversant in English.

- Upon completion of training, participants will receive an Authorized Training Certificate.

- The course duration is flexible and can be modified to fit any number of days.

- Course fee includes facilitation, training materials, 2 coffee breaks, buffet lunch, and a Certificate upon successful completion.

- One-year post-training support, consultation, and coaching provided after the course.

- Payment should be made at least a week before the training commencement to DATASTAT CONSULTANCY LTD account, as indicated in the invoice, to enable better preparation.