Training course on Blended Finance for Social Protection Initiatives

Training Course on Blended Finance for Social Protection Initiatives is meticulously designed to equip with the expert knowledge and practical methodologies to strategically design, structure, and implement blended finance solutions

Course Overview

Training Course on Blended Finance for Social Protection Initiatives

Introduction

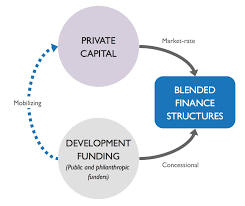

Achieving the Sustainable Development Goals (SDGs), particularly those related to poverty eradication, health, education, and reduced inequalities, demands unprecedented levels of financial investment. Public funds and traditional Official Development Assistance (ODA) alone are insufficient to bridge the substantial financing gap, especially in developing countries. Training Course on Blended Finance for Social Protection Initiatives is meticulously designed to equip with the expert knowledge and practical methodologies to strategically design, structure, and implement blended finance solutions for social protection initiatives. The program focuses on understanding catalytic capital, identifying investable opportunities, risk mitigation strategies, financial structuring, legal and regulatory frameworks, impact measurement, and navigating multi-stakeholder partnerships, blending rigorous analytical frameworks with practical, hands-on application, extensive global case studies (from diverse developed and developing country contexts), and intensive deal structuring and feasibility analysis exercises. Participants will gain the strategic foresight and technical expertise to confidently engage in complex financial transactions, fostering unparalleled resource mobilization, innovation, and sustainable impact in social protection, thereby securing their position as indispensable leaders in financing the future of inclusive development.

This intensive 10-day program delves into nuanced methodologies for conducting market assessments to identify social protection gaps amenable to blended finance solutions, mastering sophisticated techniques for designing various blended finance instruments (e.g., first-loss guarantees, concessional loans, technical assistance facilities) to effectively de-risk investments, and exploring cutting-edge approaches to structuring complex multi-stakeholder agreements, valuing social impact, developing robust impact measurement frameworks, navigating legal and regulatory environments for innovative finance, and building effective governance structures for blended finance vehicles. A significant focus will be placed on understanding the interplay of blended finance with national development priorities and existing public financial management (PFM) systems, the specific challenges of data availability and impact attribution in social sectors, and the practical application of effective communication and negotiation strategies to align diverse investor objectives.

Course Objectives:

Upon completion of this course, participants will be able to:

- Analyze core concepts and strategic responsibilities of Blended Finance and its specific application to Social Protection Initiatives.

- Master sophisticated techniques for identifying and assessing social protection needs that can be addressed through blended finance solutions.

- Develop robust methodologies for designing and selecting appropriate blended finance instruments (e.g., grants, concessional debt, guarantees, equity) to mobilize private capital.

- Implement effective strategies for structuring complex multi-stakeholder agreements that align the objectives of public, philanthropic, and private investors.

- Manage complex considerations for conducting robust risk assessments and mitigation strategies to de-risk social protection investments for commercial funders.

- Apply robust strategies for developing sound financial models and return expectations for diverse investor types within a blended finance structure.

- Understand the deep integration of blended finance with national development priorities and public financial management frameworks.

- Leverage knowledge of global best practices and lessons learned from successful blended finance initiatives that contribute to social protection outcomes in diverse country contexts.

- Optimize strategies for designing clear impact measurement frameworks and verification protocols to ensure accountability and attract impact investors.

- Formulate specialized recommendations for addressing legal, regulatory, and institutional capacity challenges in implementing blended finance in social sectors.

- Conduct comprehensive assessments of the political economy factors and stakeholder interests influencing the adoption and success of blended finance.

- Navigate challenging situations such as market failures, high transaction costs, and misaligned incentives in blended finance for social protection.

- Develop a holistic, evidence-based, and impactful approach to Blended Finance for Social Protection Initiatives, unlocking new capital for sustainable social development.

Target Audience:

This course is designed for professionals interested in Blended Finance for Social Protection Initiatives:

- Policymakers & Senior Government Officials: From Ministries of Finance, Social Protection, Planning, Health, Education, and Youth.

- Development Finance Institutions (DFIs) & Multilateral Development Banks (MDBs): Investment officers, social development specialists.

- Private Sector Investors: Commercial banks, impact investors, pension funds, institutional investors, family offices.

- Philanthropic Organizations & Foundations: Seeking to leverage their capital for greater impact.

- Social Protection Program Managers & Directors: Exploring innovative financing for program sustainability and expansion.

- Civil Society Organizations (CSOs) & Non-Profit Organizations: Delivering social services and seeking diversified funding.

- Legal & Financial Advisors: Specializing in innovative finance, project finance, and public-private partnerships.

- Academics & Researchers: Studying innovative finance, social policy, and sustainable development.

Course Duration: 10 Days

Course Modules:

- Module 1: Introduction to Blended Finance and its Development Rationale (Day 1)

- Defining blended finance: Catalytic capital, de-risking, and mobilizing private investment for SDGs.

- The global financing gap for sustainable development and the role of blended finance.

- Key actors in blended finance: Public/philanthropic providers, private investors, intermediaries, project sponsors.

- Distinguishing blended finance from traditional ODA and purely commercial finance.

- Overview of the OECD DAC Blended Finance Principles and their importance.

- Module 2: The Landscape of Social Protection and Investable Opportunities (Day 1-2)

- Broadening the scope of social protection beyond direct transfers: Health, education, skills, livelihoods, housing, financial inclusion.

- Identifying social protection challenges amenable to market-based or blended finance solutions.

- Analyzing the "missing middle" in social finance: Projects too big for grants, too risky for commercial.

- Examples of sectors where blended finance has supported social outcomes (e.g., WASH, affordable housing, healthcare supply chains, education technology).

- Case studies of social challenges that blended finance aims to address.

- Module 3: Understanding Catalytic Capital and its Instruments (Day 2-3)

- Deep dive into different forms of catalytic capital: Grants (recoverable, convertible), concessional loans (subordinated, first-loss), equity with asymmetric returns.

- Risk mitigation instruments: Guarantees (partial credit, political risk, currency risk), insurance.

- Technical assistance facilities: Supporting project preparation, capacity building, and impact management.

- How each instrument de-risks or enhances returns for private investors.

- Practical exercises: Matching catalytic instruments to specific project risks.

- Module 4: Structuring Blended Finance Deals for Social Impact (Day 3-4)

- Key elements of a blended finance transaction: Capital stack design, deal negotiation, legal agreements.

- Designing the "waterfall" of returns and losses for different tranches of capital.

- Roles and responsibilities of each stakeholder in a blended finance structure.

- Leveraging Special Purpose Vehicles (SPVs) or dedicated funds.

- Case study analysis of various blended finance structures (e.g., Development Impact Bonds for social outcomes, dedicated impact funds).

- Module 5: Risk Assessment and Mitigation for Social Protection Investments (Day 4-5)

- Identifying project-specific risks in social sectors (e.g., demand risk, operational risk, regulatory risk, political risk).

- Assessing sovereign and currency risks in developing countries.

- Due diligence processes for social impact projects.

- Strategies for mitigating risks to attract private capital: Credit enhancements, policy reforms, de-risking guarantees.

- Understanding perceived vs. actual risks in emerging markets.

- Module 6: Financial Modeling and Investor Relations (Day 5-6)

- Developing robust financial models for blended finance projects, incorporating different return expectations.

- Calculating internal rates of return (IRR) and other financial metrics for private investors.

- Articulating the investment thesis and development impact story for potential funders.

- Understanding the motivations and criteria of diverse private investors (e.g., pension funds, family offices, commercial banks).

- Negotiation strategies for optimal deal terms that balance financial and impact objectives.

- Module 7: Impact Measurement, Management, and Reporting (Day 6-7)

- Defining clear, measurable, and attributable social outcomes for blended finance initiatives.

- Developing robust Theories of Change and Logical Frameworks.

- Selecting appropriate impact indicators and metrics (e.g., IRIS+, GIIN Impact Reporting).

- Establishing independent verification and monitoring protocols.

- Challenges of impact attribution and data quality in social sectors and strategies to overcome them.

- Module 8: Legal, Regulatory, and Governance Frameworks (Day 7-8)

- Understanding legal and regulatory considerations for blended finance in different jurisdictions.

- Tax implications for various instruments and investor types.

- Establishing robust governance structures for blended finance vehicles and projects.

- Transparency and accountability mechanisms for blended finance initiatives.

- The role of national policies in creating an enabling environment for blended finance.

- Module 9: Mainstreaming and Scaling Blended Finance for Social Protection (Day 8-9)

- Identifying factors that enable or hinder the scaling of blended finance for social protection.

- From bespoke deals to programmatic approaches: Developing blended finance platforms or facilities.

- The role of technical assistance and project preparation facilities in building a pipeline.

- Leveraging blended finance for systemic change and market development in social sectors.

- Discussing opportunities for cross-sectoral blended finance that benefits social protection (e.g., green finance with social safeguards).

- Module 10: Stakeholder Engagement, Partnerships, and Communication (Day 9)

- Building effective partnerships across public, private, and philanthropic sectors.

- Strategies for effective communication to align diverse stakeholder interests and manage expectations.

- Addressing the "trust deficit" between public and private actors.

- Fostering country ownership and alignment with national development priorities.

- Learning from challenges in aligning interests in complex blended finance deals.

- Module 11: Case Studies and Lessons Learned from Global Blended Finance (Day 9-10)

- In-depth analysis of successful and challenging blended finance deals in health (e.g., Global Fund), education (e.g., Impact Bonds), WASH, and financial inclusion.

- Examining how blended finance has supported livelihoods and social safety nets indirectly.

- Critical review of the benefits and limitations of blended finance in achieving social outcomes.

- Discussion on how to measure additionality and ensure development impact.

- Lessons from various regions, including Africa, on successful blended finance initiatives that contribute to social well-being.

- Module 12: Designing a Blended Finance Concept for Social Protection (Day 10)

- Interactive workshop: Participants work in groups to develop a preliminary blended finance concept for a specific social protection challenge in a chosen country.

- Defining the problem, proposed solution, target outcomes, catalytic capital needs, and potential private investors.

- Outlining the deal structure, risk mitigation, and impact measurement approach.

- Presentation of concepts and peer feedback.

- Charting next steps for exploring and developing blended finance opportunities.

Training Methodology

- Interactive Workshops: Facilitated discussions, group exercises, and problem-solving activities.

- Case Studies: Real-world examples to illustrate successful community-based surveillance practices.

- Role-Playing and Simulations: Practice engaging communities in surveillance activities.