Training Course on Executive Compensation and Performance Linkage

Training Course on Executive Compensation and Performance Linkage delves into the intricate relationship between executive remuneration and organizational performance, equipping participants with the cutting-edge knowledge and practical tools to craft robust, compliant, and impactful compensation strategies that drive sustainable value creation and reinforce a culture of high achievement.

Course Overview

Training Course on Executive Compensation and Performance Linkage

Introduction

In today's dynamic global marketplace, effective executive compensation is no longer merely a financial transaction but a critical strategic imperative for organizational success. Boards of Directors, HR leaders, and compensation committees face immense pressure to design and implement performance-driven reward systems that attract, motivate, and retain top-tier executive talent while simultaneously satisfying shareholder expectations and navigating complex regulatory landscapes. Training Course on Executive Compensation and Performance Linkage delves into the intricate relationship between executive remuneration and organizational performance, equipping participants with the cutting-edge knowledge and practical tools to craft robust, compliant, and impactful compensation strategies that drive sustainable value creation and reinforce a culture of high achievement.

This program goes beyond traditional compensation practices, focusing on the latest trends in executive pay, including the integration of ESG metrics, the impact of artificial intelligence on compensation design, and best practices for transparent disclosure. We will explore how to architect incentive plans that truly align executive interests with long-term enterprise goals, fostering accountability and maximizing shareholder returns. Participants will gain a deep understanding of governance frameworks, risk management in compensation, and the art of communicating complex compensation philosophies to diverse stakeholders, ensuring their organizations remain competitive and ethical in a rapidly evolving business environment.

Course Duration

10 days

Course Objectives

- Develop expertise in crafting compensation frameworks that directly align with organizational strategy and long-term value creation.

- Design and implement robust performance metrics and goal-setting processes that effectively link executive pay to tangible business outcomes and shareholder returns.

- Understand the latest international and domestic trends in executive remuneration, including pay equity, sustainability (ESG) integration, and DEI impact on compensation.

- Construct effective short-term and long-term incentive plans (STIs & LTIs) utilizing trending mechanisms like performance shares, restricted stock units (RSUs), and phantom equity.

- Gain in-depth knowledge of SEC disclosure requirements, proxy advisory firm guidelines, and evolving corporate governance best practices in executive pay.

- Identify and address potential legal, reputational, and financial risks associated with executive compensation programs, including clawback policies and say-on-pay challenges.

- Utilize big data and predictive analytics to inform compensation decisions, benchmark against peer groups, and forecast future pay trends.

- Explore the emerging role of Artificial Intelligence (AI) in compensation modeling, data analysis, and personalized executive reward schemes.

- Design comprehensive executive benefits and perquisites that enhance value proposition while remaining competitive and compliant.

- Articulate complex compensation strategies clearly and persuasively to Boards, investors, employees, and the public.

- Design compensation packages that are highly competitive in the global talent market, attracting and retaining high-impact leaders.

- Cultivate an organizational culture where executive compensation transparently reinforces desired behaviors and drives accountability for strategic results.

- Develop agile compensation strategies to respond to economic volatility, geopolitical shifts, and rapid technological advancements.

Organizational Benefits

- Direct linkage of executive pay to key performance indicators (KPIs) and long-term value creation.

- Attracts and retains top-tier executive talent in a competitive global market.

- Ensures robust, transparent, and compliant compensation practices, reducing regulatory scrutiny and reputational risk.

- Motivates executives to achieve strategic objectives and drive sustainable growth.

- Ensures effective allocation of compensation budgets for maximum return on investment.

- Reduces exposure to legal challenges, shareholder activism, and negative public perception.

- Fosters a culture where executive decisions are consistently aligned with the overall business strategy.

- Positions the organization as an employer of choice for executive talent through innovative and fair compensation.

- Builds confidence among shareholders, employees, and the public through clear and ethical compensation practices.

Target Audience

- CEOs and C-Suite Executives

- Board Members and Compensation Committee Members.

- Human Resources Directors and Senior HR Professionals.

- Compensation and Benefits Specialists

- In-House Legal Counsel and Compliance Officers

- Finance Directors and CFOs.

- Investor Relations Professionals.

- Management Consultants and Advisors.

Course Outline

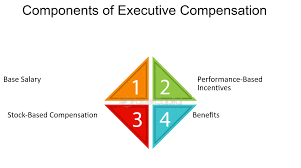

Module 1: Foundations of Executive Compensation

- Defining Executive Compensation: Beyond Base Salary

- The Strategic Role of Executive Pay in Value Creation

- Historical Evolution and Current Landscape of Executive Remuneration

- Key Stakeholders in Executive Compensation

- Case Study: Analyzing a "Too Big to Fail" executive compensation package and its public perception.

Module 2: Corporate Governance and the Compensation Committee

- Composition, Roles, and Responsibilities of the Compensation Committee

- Best Practices for Committee Effectiveness and Independence

- Fiduciary Duties and Ethical Considerations in Executive Pay

- The Influence of Proxy Advisory Firms (e.g., ISS, Glass Lewis)

- Case Study: Examining a real-world scenario of a compensation committee navigating shareholder dissent on a pay proposal.

Module 3: Understanding Performance Linkage

- Principles of Pay-for-Performance: Theory vs. Reality

- Identifying and Selecting Relevant Financial and Non-Financial Performance Metrics (e.g., EPS, ROIC, ESG)

- Setting Ambitious Yet Achievable Performance Goals

- The Role of Discretion in Performance Assessments

- Case Study: Developing performance metrics for a tech start-up transitioning to public ownership.

Module 4: Short-Term Incentive (STI) Design

- Types of STIs: Annual Bonuses, Profit Sharing, Spot Awards

- Designing Effective Bonus Plans: Payout Curves, Thresholds, Targets, Maximums

- Individual vs. Team vs. Company Performance in STIs

- Managing Risk and Unintended Consequences in Short-Term Plans

- Case Study: Redesigning an annual bonus plan to better align with specific quarterly operational goals for a manufacturing firm.

Module 5: Long-Term Incentive (LTI) Design - Equity-Based

- Overview of Equity Instruments: Stock Options, Restricted Stock, RSUs, Performance Shares

- Equity Grant Practices: Vesting Schedules, Evergreen Pools, Reload Options

- Valuation Methodologies for Equity Awards

- Accounting and Tax Implications of Equity Compensation

- Case Study: Choosing the optimal equity vehicle for a growing pharmaceutical company anticipating a major product launch.

Module 6: Long-Term Incentive (LTI) Design - Cash & Other

- Cash-Based LTIs: Performance Unit Plans, Phantom Stock, Deferred Compensation

- Hybrid LTI Structures: Combining Equity and Cash Components

- Retirement and Severance Arrangements for Executives

- Executive Perquisites and Benefits: Trends and Best Practices

- Case Study: Structuring a deferred compensation plan for a multinational corporation to optimize tax efficiency and retention.

Module 7: Market Benchmarking and Competitive Pay

- Conducting Compensation Surveys and Peer Group Analysis

- Identifying Appropriate Peer Groups: Industry, Revenue, Market Cap, Complexity

- Interpreting and Applying Market Data Effectively

- Geographic and Global Considerations in Executive Pay Benchmarking

- Case Study: Benchmarking executive compensation for a private equity-backed portfolio company preparing for an IPO.

Module 8: Regulatory Compliance and Disclosure (SEC & Beyond)

- Understanding SEC Requirements: Proxy Statement (DEF 14A), CD&A

- Executive Compensation Disclosure: Principles and Pitfalls

- Say-on-Pay and Shareholder Engagement on Compensation

- Dodd-Frank Act Provisions (e.g., Clawbacks, Pay Ratio Disclosure)

- Case Study: Drafting a compliant and compelling Compensation Discussion & Analysis (CD&A) for a public company.

Module 9: Advanced Topics in Executive Compensation Risk Management

- Mitigating Reputational Risk and Public Scrutiny

- The Role of Risk Committees in Compensation Oversight

- Developing and Implementing Effective Clawback Policies

- Crisis Management in Executive Compensation

- Case Study: Addressing a public relations challenge stemming from a controversial executive severance package.

Module 10: Emerging Trends: ESG and DEI in Compensation

- Integrating Environmental, Social, and Governance (ESG) Metrics into Incentive Plans

- Measuring and Rewarding Sustainability Performance

- Diversity, Equity, and Inclusion (DEI) as Compensation Drivers

- Ethical Considerations and Stakeholder Capitalism in Executive Pay

- Case Study: Designing a new LTI component that explicitly ties a portion of executive pay to achieving specific carbon emission reduction targets.

Module 11: The Impact of Technology and AI on Compensation

- Leveraging Compensation Software and Analytics Platforms

- Predictive Analytics for Compensation Forecasting and Planning

- The Future of Work and its Implications for Executive Pay Structures

- Exploring AI's Role in Compensation Data Analysis and Recommendation Engines

- Case Study: Implementing a new HRIS module for comprehensive executive compensation data management and reporting.

Module 12: Executive Compensation for Private and Non-Profit Organizations

- Unique Compensation Challenges in Private Companies and Family Businesses

- Designing Incentive Structures for Private Equity-Backed Firms

- Executive Compensation in Non-Profit and Tax-Exempt Organizations

- Succession Planning and Retention Strategies in Non-Public Entities

- Case Study: Developing a founder exit compensation strategy for a rapidly growing privately held company.

Module 13: Communication and Stakeholder Engagement

- Effective Communication Strategies for Executive Compensation Decisions

- Engaging with Shareholders, Employees, and the Board on Pay Philosophy

- Building Trust and Transparency in Compensation Practices

- Handling Criticism and Defending Compensation Decisions

- Case Study: Preparing a presentation to the Board to justify a significant change in the executive long-term incentive plan.

Module 14: Legal and Tax Considerations

- Section 409A and Deferred Compensation Rules

- Section 162(m) and Performance-Based Compensation Limitations

- Insider Trading Rules and Executive Stock Ownership

- International Tax Implications for Global Executives

- Case Study: Analyzing the tax implications of various equity award types for a cross-border executive.

Module 15: Future of Executive Compensation and Strategic Adaptation

- Anticipating Regulatory Changes and Market Shifts

- Developing Agile Compensation Strategies for Disruption

- The Role of the Chief Human Resources Officer (CHRO) in Executive Compensation

- Continuous Improvement and Evaluation of Compensation Programs

- Case Study: Crafting a contingency plan for executive compensation in the event of a major economic downturn or geopolitical crisis.

Training Methodology

This intensive training course will employ a multifaceted and highly interactive methodology to ensure maximum learning and practical application:

- Expert-Led Lectures: Engaging presentations delivering foundational knowledge and current trends.

- Interactive Workshops & Group Exercises: Hands-on activities to apply concepts, solve problems, and collaborate with peers.

- Real-World Case Studies & Discussions: In-depth analysis of actual executive compensation scenarios, fostering critical thinking and strategic decision-making.

- Role-Playing Simulations: Practical exercises to simulate Board meetings, compensation committee discussions, and stakeholder engagement.

- Guest Speakers: Insights from leading compensation consultants, legal experts, and senior HR/Board members.

- Peer-to-Peer Learning: Opportunities for knowledge sharing and networking among participants.

- Q&A Sessions: Dedicated time for addressing specific challenges and questions.

- Practical Tools & Templates: Provision of actionable frameworks, checklists, and models for immediate application.

Register as a group from 3 participants for a Discount

Send us an email: info@datastatresearch.org or call +254724527104

Certification

Upon successful completion of this training, participants will be issued with a globally- recognized certificate.

Tailor-Made Course

We also offer tailor-made courses based on your needs.

Key Notes

a. The participant must be conversant with English.

b. Upon completion of training the participant will be issued with an Authorized Training Certificate

c. Course duration is flexible and the contents can be modified to fit any number of days.