Training Course on Investment Projects- Analysing Costs, Benefits and Making Strategic Decisions

Training Course on Investment Projects- Analysing Costs, Benefits and Making Strategic Decisions is meticulously designed to equip participants with the essential skills and knowledge for rigorous investment analysis and informed strategic decision-making.

Course Overview

Training Course on Investment Projects- Analysing Costs, Benefits and Making Strategic Decisions

Introduction

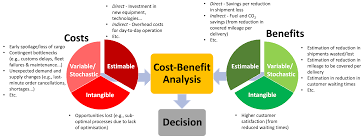

This intensive training course, "Investment Projects: Analysing Costs, Benefits and Making Strategic Decisions," is meticulously designed to equip participants with the essential skills and knowledge for rigorous investment analysis and informed strategic decision-making. In today's dynamic economic landscape, the ability to accurately evaluate the financial viability and potential of investment projects is paramount for organizational success and sustainable growth. This course delves into critical techniques for cost-benefit analysis, financial modelling, and risk assessment, providing a comprehensive framework for making sound investment choices that align with overarching organizational objectives. Participants will gain practical expertise in applying key financial metrics and qualitative factors to ensure optimal resource allocation and the selection of value-enhancing projects.

The curriculum emphasizes a hands-on approach, blending theoretical foundations with practical application through case studies and exercises focused on real-world scenarios. By mastering the principles of net present value (NPV), internal rate of return (IRR), and payback period, alongside understanding the nuances of financial forecasting and sensitivity analysis, participants will be empowered to critically assess project proposals. Furthermore, the course highlights the importance of integrating qualitative risk factors and stakeholder analysis into the decision-making process, fostering a holistic understanding of investment project evaluation. Ultimately, this training will enhance participants' ability to contribute strategically to their organizations by driving profitable and sustainable investment initiatives.

Course Duration

5 days

Course Objectives

- Understand the fundamental principles of investment appraisal and their strategic importance.

- Master the techniques for conducting thorough cost-benefit analysis of investment projects.

- Learn to apply discounted cash flow (DCF) analysis for project valuation.

- Calculate and interpret key financial metrics such as Net Present Value (NPV) and Internal Rate of Return (IRR).

- Develop proficiency in financial modeling using industry-standard tools and techniques.

- Conduct effective sensitivity analysis and scenario planning to evaluate project risks.

- Integrate risk assessment methodologies into the investment decision-making process.

- Understand the impact of inflation and the time value of money on investment projects.

- Learn to identify and quantify intangible benefits and qualitative costs in project analysis.

- Apply stakeholder analysis to understand and manage the interests of relevant parties.

- Evaluate different capital budgeting techniques and their applicability.

- Develop skills in preparing and presenting compelling investment proposals and reports.

- Make informed strategic decisions based on comprehensive financial and economic evaluations.

Organizational Benefits

- Improved Capital Allocation: Equipping employees with robust analytical skills ensures that investment decisions are data-driven, leading to more efficient allocation of capital resources to the most promising projects.

- Enhanced Project Success Rates: A thorough understanding of cost-benefit analysis and risk assessment minimizes the likelihood of investing in unprofitable or unsustainable ventures, thereby increasing overall project success rates.

- Better Strategic Alignment: Training ensures that investment decisions are aligned with the organization's strategic goals and objectives, contributing directly to the achievement of long-term vision.

- Increased Profitability: By focusing on projects with strong financial viability and potential for high returns, the organization can improve its overall profitability and shareholder value.

- Reduced Financial Risks: Comprehensive risk assessment and mitigation techniques learned in the course help the organization proactively manage potential financial losses associated with investments.

- Enhanced Decision-Making Confidence: Well-trained professionals are more confident in their investment recommendations, leading to more decisive and effective strategic actions.

- Standardized Evaluation Processes: The course promotes a consistent and standardized approach to evaluating investment opportunities across different departments and project teams.

- Improved Communication with Stakeholders: Participants learn to effectively communicate the financial rationale behind investment decisions to various stakeholders, fostering transparency and trust.

Target Participants

- Project Managers and Coordinators

- Financial Analysts and Advisors

- Investment Analysts

- Business Development Managers

- Strategic Planners and Consultants

- Finance Directors and Controllers

- Government Officials involved in public sector projects

- Corporate Decision-Makers and Executives

Course Outline

Module 1: Foundations of Investment Project Analysis

- Introduction to investment appraisal and its importance in strategic management.

- Understanding the project lifecycle and key decision points.

- Overview of different types of investment projects and their characteristics.

- The concept of value creation and its relevance to investment decisions.

- Ethical considerations in investment analysis.

Module 2: Cost Identification and Analysis

- Identifying and classifying different types of project costs (direct, indirect, fixed, variable).

- Techniques for accurate cost estimation and forecasting.

- Understanding the impact of opportunity costs and sunk costs.

- Analyzing cost drivers and cost structures in investment projects.

- Methods for cost control and monitoring throughout the project lifecycle.

Module 3: Benefit Identification and Analysis

- Identifying and categorizing different types of project benefits (tangible, intangible, direct, indirect).

- Techniques for quantifying and valuing project benefits.

- Understanding the concept of return on investment (ROI) and its limitations.

- Analyzing the strategic benefits and alignment of investment projects.

- Considering social and environmental benefits in project evaluation.

Module 4: Discounted Cash Flow (DCF) Analysis

- Understanding the time value of money and the concept of discounting.

- Calculating the present value of future cash flows.

- Determining the appropriate discount rate (cost of capital).

- Applying the Net Present Value (NPV) rule for investment decisions.

- Calculating and interpreting the Internal Rate of Return (IRR).

Module 5: Advanced Financial Evaluation Techniques

- Understanding the Modified Internal Rate of Return (MIRR).

- Calculating and using the Profitability Index (PI).

- Analyzing the Payback Period and Discounted Payback Period.

- Comparing and contrasting different capital budgeting techniques.

- Addressing the limitations of financial metrics in isolation.

Module 6: Risk Assessment and Sensitivity Analysis

- Identifying and categorizing potential risks in investment projects (financial, operational, market, etc.).

- Qualitative and quantitative techniques for risk assessment.

- Developing risk mitigation strategies and contingency plans.

- Conducting sensitivity analysis to evaluate the impact of changing variables.

- Applying scenario planning to assess project viability under different conditions.

Module 7: Stakeholder Analysis and Strategic Alignment

- Identifying key stakeholders and their interests in investment projects.

- Analyzing stakeholder power and influence.

- Developing strategies for effective stakeholder engagement.

- Aligning investment decisions with the organization's strategic objectives and priorities.

- Considering the impact of investment projects on corporate social responsibility (CSR).

Module 8: Making Strategic Investment Decisions and Reporting

- Integrating financial and non-financial factors in the decision-making process.

- Developing a framework for evaluating and prioritizing investment opportunities.

- Preparing comprehensive investment proposals and reports.

- Communicating investment recommendations to decision-makers effectively.

- Post-investment review and performance evaluation.

Training Methodology

This training course employs a blended learning approach to maximize participant engagement and knowledge retention. The methodology includes:

- Interactive Lectures: Providing foundational knowledge and key concepts through engaging presentations.

- Case Studies: Analyzing real-world investment projects to apply learned techniques and foster critical thinking.

- Group Discussions: Encouraging peer-to-peer learning and the sharing of diverse perspectives and experiences.

- Practical Exercises: Hands-on application of financial analysis tools and techniques using spreadsheets and potentially specialized software.

- Role-Playing: Simulating investment decision-making scenarios to enhance strategic thinking and communication skills.

- Q&A Sessions: Providing opportunities for participants to clarify doubts and deepen their understanding.

Register as a group from 3 participants for a Discount

Send us an email: info@datastatresearch.org or call +254724527104

Certification

Upon successful completion of this training, participants will be issued with a globally- recognized certificate.

Tailor-Made Course

We also offer tailor-made courses based on your needs.

Key Notes

a. The participant must be conversant with English.

b. Upon completion of training the participant will be issued with an Authorized Training Certificate

c. Course duration is flexible and the contents can be modified to fit any number of days.

d. The course fee includes facilitation training materials, 2 coffee breaks, buffet lunch and A Certificate upon successful completion of Training.

e. One-year post-training support Consultation and Coaching provided after the course.

f. Payment should be done at least a week before commence of the training, to DATASTAT CONSULTANCY LTD account, as indicated in the invoice so as to enable us prepare better for you