Training Course on Managerial Finance

Training Course on Managerial Finance provides comprehensive insights into financial principles, strategic management, and performance evaluation, equipping professionals to make informed decisions and maximize organizational value.

Course Overview

Training Course on Managerial Finance

Introduction

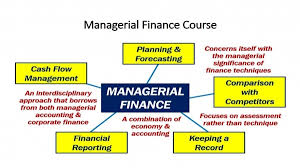

Managerial Finance is a critical area in the modern business landscape, focusing on the strategic management of an organization’s financial resources. It empowers decision-makers with the tools to analyze financial data, manage investments, and optimize profitability through sound financial planning and risk management techniques. This course provides comprehensive insights into financial principles, strategic management, and performance evaluation, equipping professionals to make informed decisions and maximize organizational value. Understanding financial metrics, budgeting, forecasting, and capital structure are just a few of the key components taught in this training, ensuring participants are well-versed in managing financial health in a competitive environment.

As organizations navigate increasingly complex financial environments, the demand for skilled financial managers grows. This course aims to bridge the knowledge gap, focusing on essential skills like cash flow analysis, financial forecasting, cost of capital, and strategic financial planning. Through practical case studies and real-world scenarios, participants will gain hands-on experience, enabling them to apply financial strategies that directly impact the bottom line. Whether you're an experienced financial professional or someone looking to enhance your financial literacy, this course will prepare you to meet the challenges of managerial finance with confidence and competence.

Course Duration

10 days

Course Objectives

- Understand the key principles of Managerial Finance and their application in business decision-making.

- Master financial statement analysis and its role in evaluating organizational performance.

- Learn how to manage corporate capital structure for maximum efficiency and growth.

- Apply financial forecasting techniques to predict future performance and guide strategic planning.

- Gain insights into capital budgeting methods for investment decisions and resource allocation.

- Analyze cost of capital and its impact on financing decisions and project evaluation.

- Develop proficiency in risk management techniques and their application in financial decision-making.

- Understand the role of working capital management in maintaining liquidity and operational efficiency.

- Assess the importance of financial planning and budgeting in achieving organizational objectives.

- Explore the implications of corporate governance on financial decisions and organizational success.

- Learn strategies for managing and optimizing cash flow in dynamic market conditions.

- Study the concept of financial leverage and its impact on the profitability of an organization.

- Apply financial knowledge to evaluate mergers and acquisitions as strategic growth tools.

Organizational Benefits

- Improved financial literacy across all management levels.

- Enhanced decision-making based on sound financial analysis.

- More effective budgeting and resource allocation.

- Increased profitability through better cost management.

- Optimized investment decisions and capital expenditure.

- Efficient management of working capital and cash flow.

- Reduced financial risks and improved financial stability.

- Enhanced communication and collaboration between finance and other departments.

- Greater accountability for financial performance.

- Alignment of financial goals with overall organizational strategy.

Target Participants

- Finance Managers seeking to enhance their strategic financial management skills.

- Corporate Executives involved in high-level financial decision-making.

- Accounting professionals looking to transition into managerial finance roles.

- Entrepreneurs and small business owners managing their company’s finances.

- Investment analysts analyzing corporate performance and making investment decisions.

- Graduates aiming to build a career in finance or corporate management.

- Individuals seeking to understand financial metrics to improve business performance.

- Consultants offering financial advisory services to organizations.

Course Outline

1: Introduction to Managerial Finance

- Definition and Scope of Managerial Finance

- Key Roles of Financial Managers

- Principles of Financial Management

- Importance of Financial Decision Making

- Ethical Considerations in Managerial Finance

2: Financial Statement Analysis

- Structure of Financial Statements

- Analyzing the Balance Sheet

- Income Statement and Cash Flow Statement Analysis

- Financial Ratios: Profitability, Liquidity, and Solvency

- Interpreting Financial Data for Decision-Making

3: Cost of Capital and Capital Structure

- Understanding the Cost of Equity and Debt

- Optimal Capital Structure Theory

- Impact of Debt on Corporate Financial Performance

- Calculating Weighted Average Cost of Capital (WACC)

- Practical Applications in Business Finance

4: Financial Planning and Forecasting

- The Role of Financial Forecasting

- Methods of Financial Forecasting

- Long-term vs. Short-term Financial Planning

- Budgeting and Forecasting Tools

- Analyzing Forecasting Accuracy

5: Risk Management in Finance

- Types of Financial Risk (Market, Credit, Operational)

- Risk Mitigation Techniques

- Financial Derivatives for Hedging

- Portfolio Diversification Strategy

- Assessing Risk and Return Trade-Offs

6: Working Capital Management

- Importance of Working Capital

- Managing Cash and Accounts Receivable

- Inventory Management and Control

- Short-term Financing Options

- Managing Payables and Collections

7: Capital Budgeting Techniques

- Importance of Capital Budgeting

- Net Present Value (NPV) Method

- Internal Rate of Return (IRR) Method

- Payback Period and Discounted Payback Period

- Case Studies and Real-World Applications

8: Financial Performance Metrics

- Key Performance Indicators (KPIs) in Finance

- Return on Investment (ROI) and Return on Assets (ROA)

- Earnings Per Share (EPS) and its Impact on Stock Prices

- Financial Performance vs. Operational Performance

- Benchmarking Financial Performance

9: Financial Leverage and Profitability

- Definition and Use of Financial Leverage

- Impact of Leverage on Profitability

- Risk and Return Relationship

- Leverage Ratios and Analysis

- Strategies for Managing Financial Leverage

10: Corporate Finance and Governance

- The Role of Corporate Governance in Finance

- Shareholder vs. Stakeholder Perspective

- Financial Regulations and Compliance

- Governance and Its Impact on Financial Decisions

- Ethical Practices in Corporate Finance

11: Cash Flow Management

- Understanding Cash Flow Statements

- Managing Operating, Investing, and Financing Cash Flows

- The Importance of Free Cash Flow

- Forecasting Cash Flow Needs

- Techniques for Cash Flow Optimization

12: Mergers, Acquisitions, and Corporate Restructuring

- Strategic Rationale for Mergers and Acquisitions

- Financial Evaluation of Mergers and Acquisitions

- Due Diligence Process

- Corporate Restructuring and Financial Impact

- Case Studies on Mergers and Acquisitions

13: Ethics in Managerial Finance

- Financial Reporting and Ethical Standards

- Fraud Prevention in Financial Reporting

- Ethical Dilemmas in Financial Decision Making

- Regulatory Framework for Financial Ethics

- Promoting Transparency in Financial Practices

14: Advanced Topics in Managerial Finance

- Corporate Valuation Techniques

- International Financial Management

- Advanced Risk Management Strategies

- Financial Innovation and Technology in Finance

- Behavioral Finance and Its Impact on Decision Making

15: Capstone Project and Case Studies

- Real-World Financial Case Studies

- Application of Course Concepts to Business Scenarios

- Financial Analysis and Decision-Making in Action

- Group Presentations and Discussions

- Feedback and Course Wrap-up

Training Methodology

- Interactive Lectures: Focused on explaining fundamental concepts with industry examples.

- Case Studies: Real-life financial scenarios that highlight best practices and problem-solving techniques.

- Hands-on Exercises: Exercises to develop practical skills in financial analysis, budgeting, and forecasting.

- Group Discussions: Collaborative learning through team-based problem-solving sessions.

- Assessments: Quizzes, tests, and projects to measure progress and knowledge retention.

Register as a group from 3 participants for a Discount

Send us an email: info@datastatresearch.org or call +254724527104

Certification

Upon successful completion of this training, participants will be issued with a globally- recognized certificate.

Tailor-Made Course

We also offer tailor-made courses based on your needs.

Key Notes

a. The participant must be conversant with English.

b. Upon completion of training the participant will be issued with an Authorized Training Certificate

c. Course duration is flexible and the contents can be modified to fit any number of days.

d. The course fee includes facilitation training materials, 2 coffee breaks, buffet lunch and A Certificate upon successful completion of Training.

e. One-year post-training support Consultation and Coaching provided after the course.

f. Payment should be done at least a week before commence of the training, to DATASTAT CONSULTANCY LTD account, as indicated in the invoice so as to enable us prepare better for you